Being There for Ball State Students

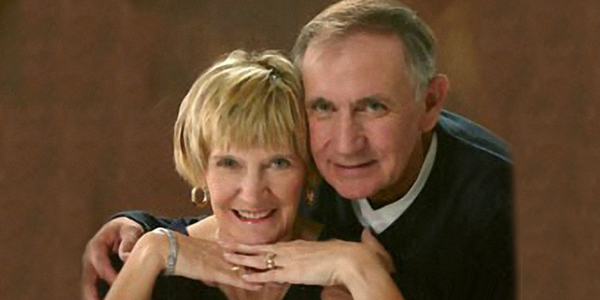

When David (BS '71) and Judy (BS '72) Lamper decided to attend Ball State, they needed a little financial help. When they graduated, they were able to give back so other students could receive the help they needed as well.

As nontraditional students commuting every day from Alexandria, Ind., where they lived with their young daughter, Robin, the Lampers needed financial aid so they could both attend Ball State. Knowing that Ball State President John Pruis was always there for the students, the Lampers went directly to him and asked for help. Following the meeting, he encouraged their application for financial aid.

As a veteran, David received financial aid through the G.I. Bill. They ultimately received a $400 scholarship allowing Judy to attend Ball State as well.

"If President Pruis and the financial aid office had not given us a fair evaluation of our financial aid request, we would not have had the opportunity to get our degrees," said David, who passed away in 2015. "Most of us can remember at least one defining moment in our lives, and for us that was the moment."

Their Ball State degrees enabled them to find careers in the areas they loved. David worked in federal criminal investigations in Chicago as a U.S. postal inspector, while Judy taught high school and was the cheerleading coordinator for all sports in the Barrington, Ill., community school district.

Giving Back With a Win-Win Gift

The Lampers decided to give back to Ball State because of the help they received. "The primary value of our gift is knowing we may help other students get

their degree," David said.

The couple chose to donate through a deferred charitable gift annuity because it provides them with extra retirement income for the rest of their lives. In addition, the residual of their gift will ultimately help students. Judy and David felt that an unrestricted gift was best, as it will allow Ball State to use their donation where it is needed most.

"We thought it was the right gift for us because we could get the tax deduction, defer the annuity payments for several years, as well as help Ball State students," David said.

Like former President Pruis and so many other alumni, the Lampers are there for the students.

Make a Greater Impact

Follow your passion with a gift to the Ball State University Foundation. Contact D. Mark Helmus at 765-285-8312 or [email protected] for details.

The information on this website is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. Figures cited in examples are for illustrative purposes only. References to tax rates include federal